tax benefit rule definition and examples

For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included. State income tax refund fully includable.

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

A tax benefit in the prior taxable year from that itemized deduction.

. Consider a taxpayer who pays 10000 of state income taxes in year 1. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year. The gross revenue for the financial year 2019 totaled 1500000 whereas the total.

Legal Definition of tax benefit rule. Tax benefit rule definition based on common meanings and most popular ways to define words related to tax benefit rule. In tax terminology the phrase tax benefit rule refers to whether or not a refund or recovery received in a future year is taxable.

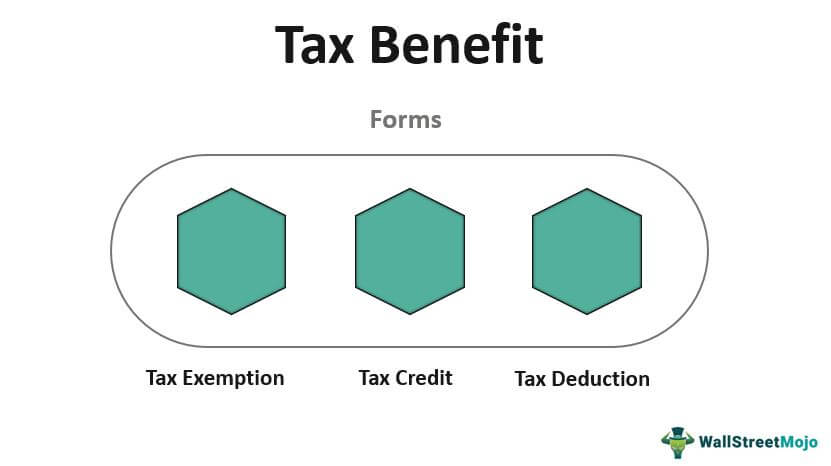

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period. What Are Tax Credits And. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden.

Examples of tax benefit. In 2019 A received a 1500 refund of state income taxes paid in 2018. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of. You must typically meet certain. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the.

Tax equity is the concern about the fairness of how the tax burden is distributed. Thesaurus for Tax benefit. The tax benefit rule is.

The term tax benefit refers to any tax law that helps you reduce your tax liability. Perhaps this is already obvious. The tax benefit rule states that if a deduction is taken in a prior year and.

For example whether or not a state income. However in 2012 the taxpayer receives a state tax refund. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a.

Whats the definition of Tax benefit rule in thesaurus. The benefits received rule argues that those who receive the greatest benefit from the government either directly or indirectly should pay the most taxes in principle of. Example of Tax Benefit Business XY is into the business of providing readymade garments for men.

A tax benefit is a tax deduction credit or other allowance that ultimately helps individuals or businesses reduce their tax liability. Something regarded as a normative example. Examples of tax benefit.

Why Does a Tax Benefit Matter. Examples of this include educational assistance programs which are tax free up to 5250 in the 2019 tax year and transportation benefits which are. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in.

Most related wordsphrases with sentence examples define Tax benefit rule meaning and usage. What is the Tax Benefit Rule. Tax equity is not a question that economists can fully answer because it also.

Tax benefit rule n. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

Annuity Taxation How Various Annuities Are Taxed

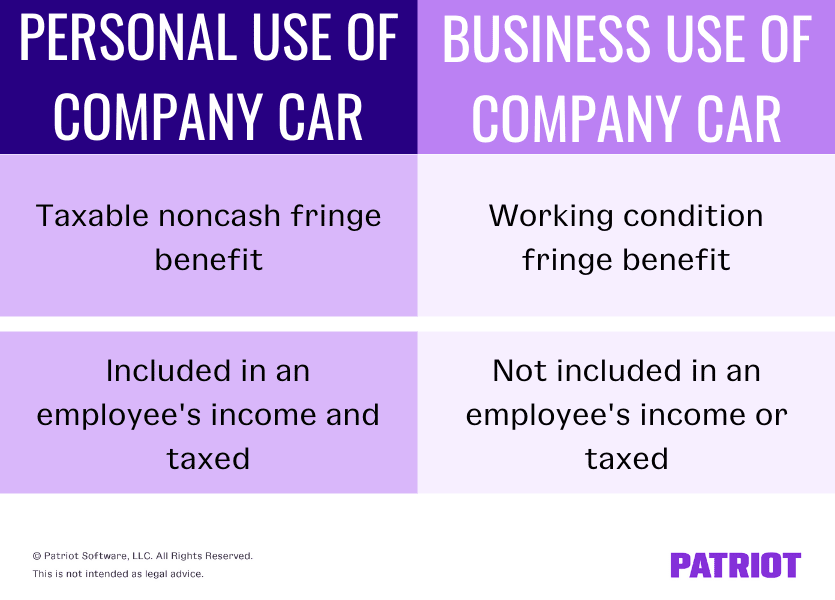

Personal Use Of Company Car Pucc Tax Rules And Reporting

Tax Deduction Definition Taxedu Tax Foundation

A Complete Guide To Reit Taxes The Ascent By Motley Fool

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Pass Through Entity Definition Examples Advantages Disadvantages

State And Local Tax Salt Deduction What It Is How It Works Bankrate

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

What Is The Tax Benefit Rule Thestreet

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

What Is Deferred Income Tax Definition Purpose And Examples

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Taxable Non Taxable Benefits Definition Examples Video Lesson Transcript Study Com

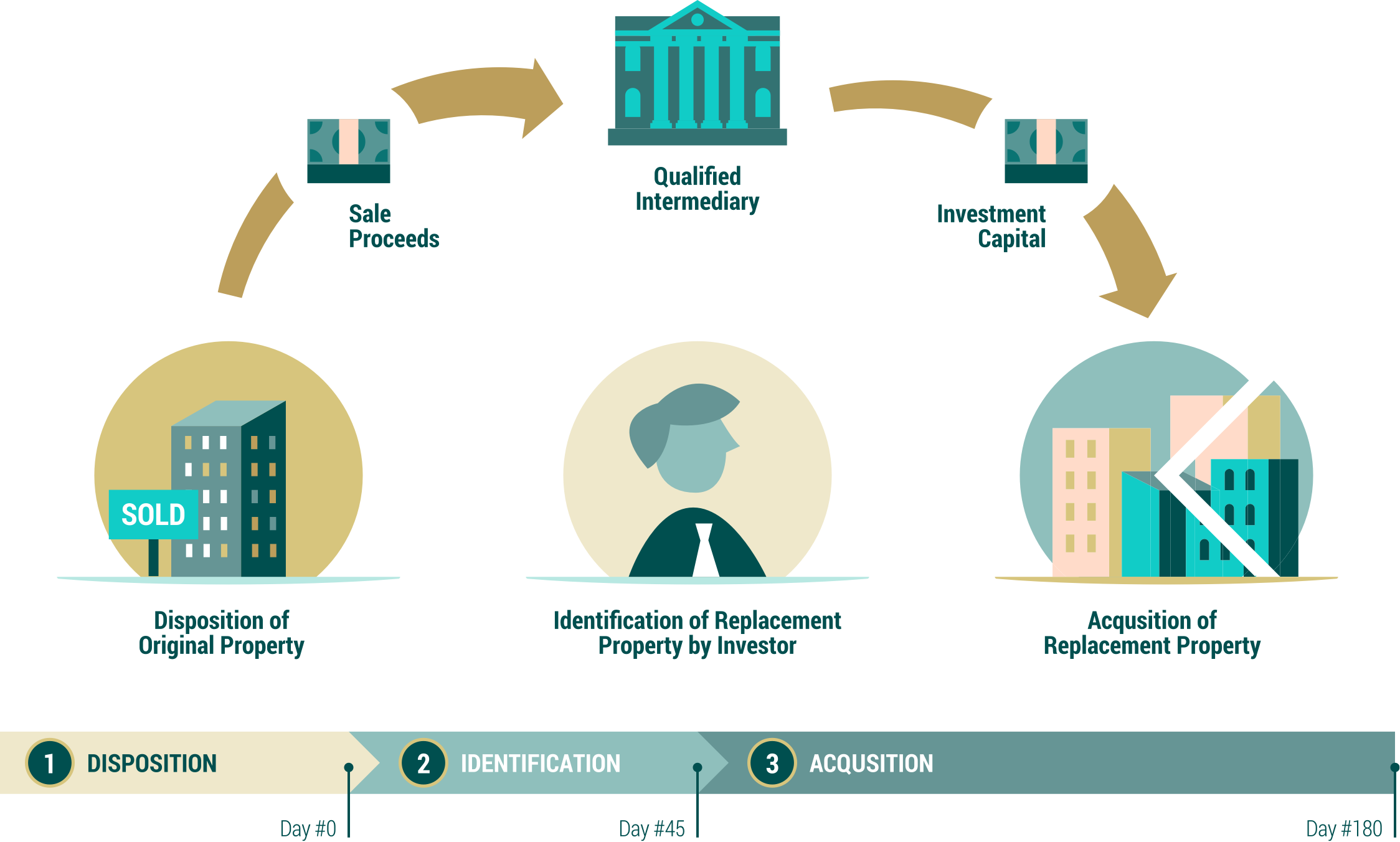

The 721 Exchange Or Upreit A Simple Introduction

Tax Benefit Meaning Examples How Tax Benefit Works

:max_bytes(150000):strip_icc()/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)