net operating working capital investopedia

To calculate it use the following. Ad Get Working Capital Funding Fast.

:max_bytes(150000):strip_icc()/Term-Definitions_Private-equity-673345d975244a9894e68d9b072a7969.png)

Private Equity Explained With Examples And Ways To Invest

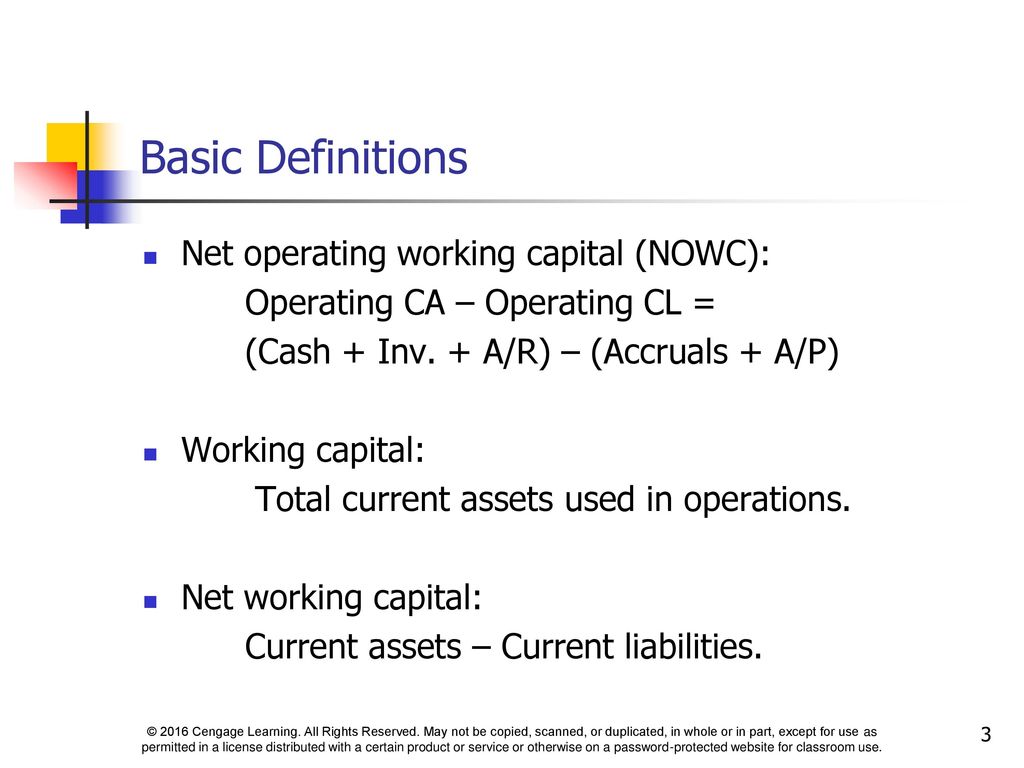

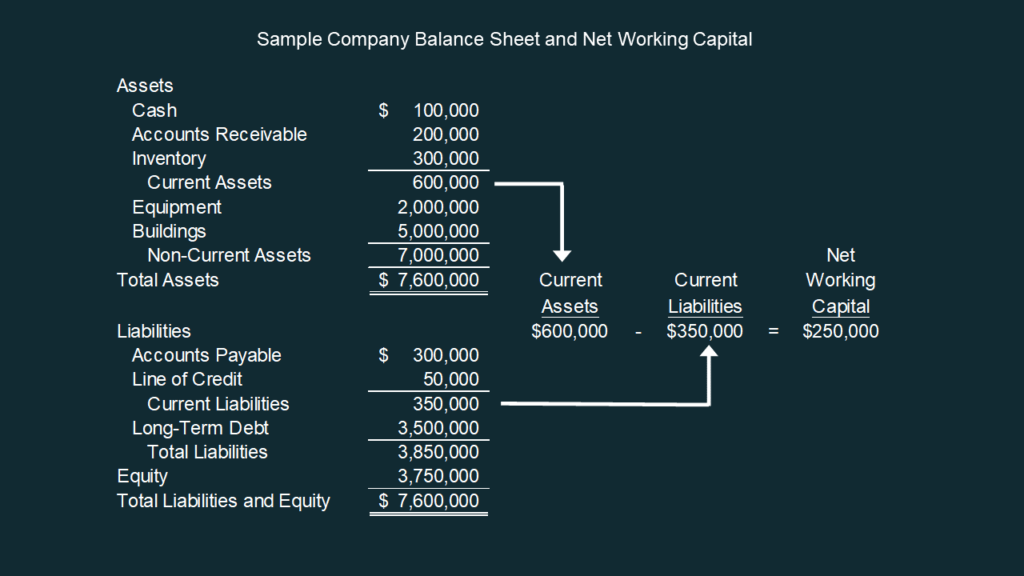

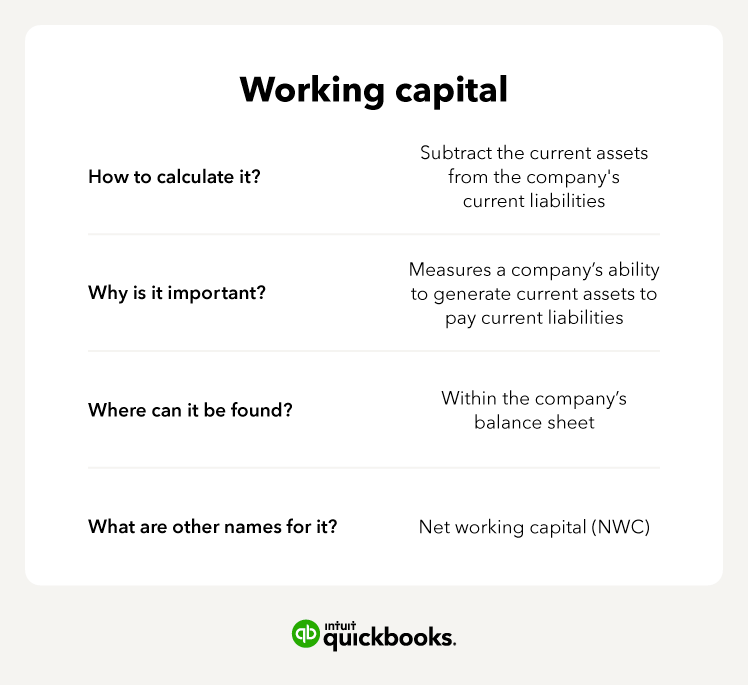

Working capital also called net working capital is the amount of money a company has available to pay its short-term expenses.

. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. Total Net Operating Capital. It includes inventories accounts.

Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. Ad Find working capital in Business Books on Amazon. Go to the LendingTree Official Site Get Offers.

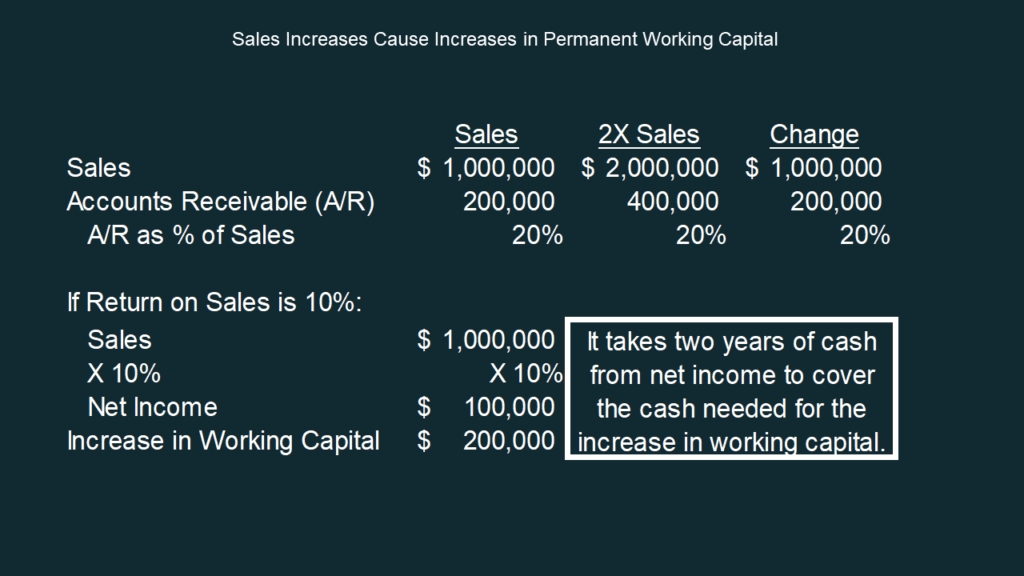

Example of Working Capital Turnover. Operating working capital focuses more on day-to-day operations whereas net working capital. Net Operating Assets calculated using the financing approach have the following formula.

Companies that have a large. Those that do understand have a huge upper-hand in. In essence the net working capital is the current assets less the current.

Net Operating Assets Equity Short-term and Long-Term Non-Operating Debts Non-Current. Compare up to 5 Loans Without a Hard Credit Pull. Net operating working capital refers to the excess of operating current assets over current operating liabilities.

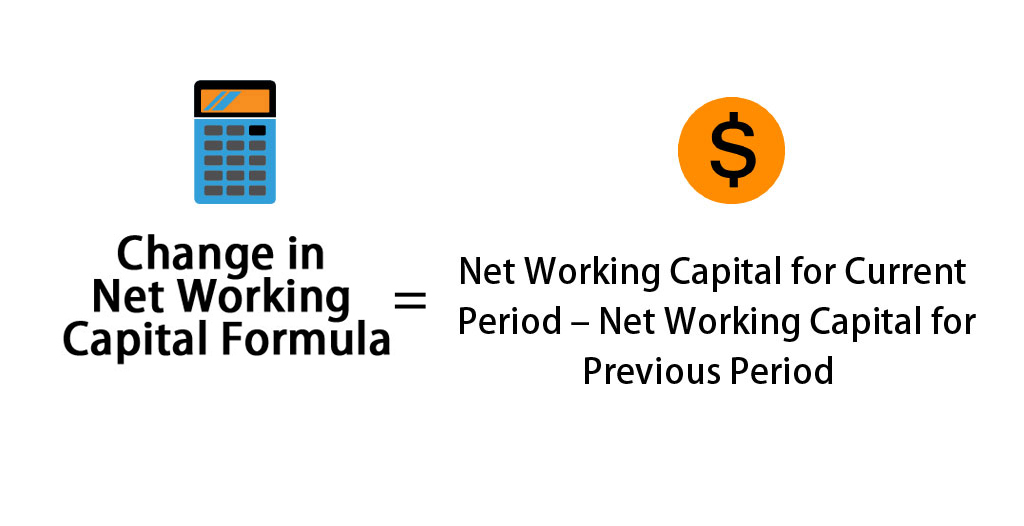

Easy Online Form Up to 5M as Fast as 24hrs Low Rates Connect With Top Lenders. Net annual sales divided by the average amount of working capital during the same year. Net Working Capital NWC is not the same thing as the Net Operating Working Capital NOWC.

Total net operating capital represents all the current and non-currents assets used by a business in its operations. The working capital turnover ratio is calculated as follows. Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities.

Ad Click Now Get the Best Rates for Working Capital Loans in 2022. Check out our trade and receivables financing options. Net operating working capital refers to the excess of operating current assets over current operating liabilities.

You can calculate net operating working capital by adding total Cash. Working capital is a financial metric which represents operating liquidity available to a business organisation or other entity including governmental entities. Along with fixed assets such as.

Operating working capital is a narrower measure than net working capital. Get Approved in 5 Min.

:max_bytes(150000):strip_icc()/operatingmargin2-0ea7e3aeb5e5473bb2f5a174217c4396.png)

Operating Margin What It Is And The Formula For Calculating It With Examples

:max_bytes(150000):strip_icc()/operatingactivities-3-2-final-df6c94a4401647b19d74f4eece1b2d6a.png)

What Are Operating Activities And What Are Some Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Weighted Average Cost Of Capital Wacc Explained With Formula And Example

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/final_daysworkingcapital_primary_definition_1011-c4e81209c4b14f52bc9e44c7d28522f4.png)

Days Working Capital Definition Calculation And Example

:max_bytes(150000):strip_icc()/operatingprofit_final_0901-ab76547e50be4425a7a264d2c2fbfa1a.png)

Operating Profit How To Calculate What It Tells You Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Net Working Capital Formulas Examples And How To Improve It

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

:max_bytes(150000):strip_icc()/Term-Definitions_noi_FINAL-d689f65b60e140f08ea8b3451d82ebce.png)

Net Operating Income Noi Definition Calculation Components And Example

:max_bytes(150000):strip_icc()/Capitalizationrate-122a804a049444c788fceb400986e3df.jpg)

Capitalization Rate Cap Rate Defined With Formula And Examples

Net Operating Working Capital What It Is And How To Calculate It

:max_bytes(150000):strip_icc()/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

Operating Working Capital Owc Formula And Calculation

:max_bytes(150000):strip_icc()/dotdash-what-are-major-differences-between-investment-banking-and-private-equity-Final-36b2c17dd9c447278b790d76f7c66b31.jpg)

Investment Banking Vs Private Equity

Working Capital Definition Formula Management Tips Article